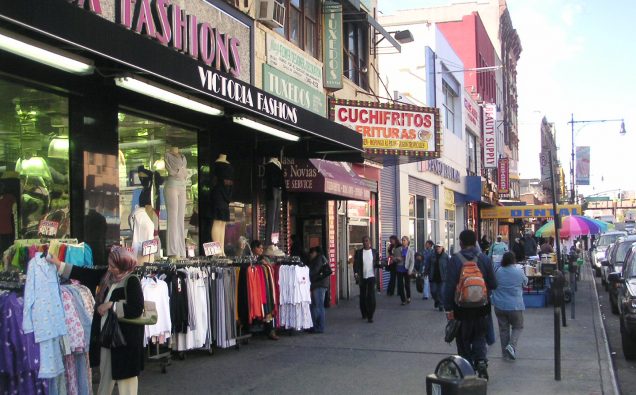

Photo by User:Knulclunk/Wikimedia Commons shows a view of Spanish Harlem in NYC

The release of a new report estimating a $ 2.5 trillion addition to the US. economy through a universal basic income plan for all Americans has re-ignited discussion on the idea and its many dimensions.

According to Roosevelt Institute, an unconditional distribution of $1,000 to each American adult under a federal spending plan could expand the US economy by roughly $2.5 trillion over eight years.

The think tank uses the Levy Institute macroeconometric model to guage effects of three versions of such cash assistance program over an eight-year time horizon.

“Overall, we find that the economy can not only withstand large increases in federal spending, but could also grow thanks to the stimulative effects of cash transfers on the economy,” authors of the report entitled ‘Modeling the Macroeconomic Effects of a Universal Basic Income.’

The experts look at an array of dimensions including economic inclusion, work and labor, and analyze three versions of cash handouts – $1,000 a month to all adults, $500 a month to all adults, and a $250 a month child allowance.

The researchers, according to the think tank, model the macroeconomic effects of these transfers using two different financing plans – increasing the federal debt, or fully funding the increased spending with increased taxes on households – and compare the effects to the Levy model’s baseline growth rate forecast.

In the event of the smallest spending scenario, $250 per month for each child, GDP is 0.79% larger than under the baseline forecast after eight years. According to the Levy Model, the largest cash program – $1,000 for all adults annually – expands the economy by 12.56% over the baseline after eight years. After eight years of enactment, the stimulative effects of the program dissipate and GDP growth returns to the baseline forecast, but the level of output remains permanently higher, the report says

As released by the think tank, the study comes out with the following findings:

“For all three designs, enacting a UBI and paying for it by increasing the federal debt would grow the economy.

When paying for the policy by increasing taxes on households, the Levy model forecasts no effect on the economy. In effect, it gives to households with one hand what it is takes away with the other.

However, when the model is adapted to include distributional effects, the economy grows, even in the tax-financed scenarios. This occurs because the distributional model incorporates the idea that an extra dollar in the hands of lower income households leads to higher spending. In other words, the households that pay more in taxes than they receive in cash assistance have a low propensity to consume, and those that receive more in assistance than they pay in taxes have a high propensity to consume. Thus, even when the policy is tax- rather than debt-financed, there is an increase in output, employment, prices, and wages.”

But the research is based on some key assumptions that the economy currently is not operating near potential output, unconditional cash transfers do not reduce household labor supply; and increasing government revenue by increasing taxes levied on households does not change household behavior.

The idea of materializing a UBI has been around for some time. Recently, Canada has used it while Kenya is going to implement it as well.

Analysts have long seen introduction of a UBI in the United States from both angles – the positive effects and negative implications.

Several proponents see the idea at this point in time a necessity for a variety of reasons: the distribution of money under the plan will help ease financial burdens on individuals and families; it will help fulfill basic needs of nutrition, health and shelter.

More importantly, introduction of such a plan would help reduce poverty which, according to U.S. Census was 12.7 percent in 2016. The availability of unconditional money will also help unleash talent in many ways – by giving enough time and freedom to young innovators and entrepreneurs to tide over basic survival worries and implement their ideas. In a nutshell, the program – seen as a welfare plan – will provide some kind of level-playing field for beginners, relieve students of debt burden and help many to advance their work inventively and achieve socioeconomic upward mobility.

On the other hand, opponents of the idea argue that it would make individuals and families more dependent on the government and turn people lazy with little motivation to excel. Critics also fear such access to easy money would render a large workforce unproductive.

While both sides have some cogent arguments based on studies, it seems the idea has a lot of benefits in the short-term for Americans in the face of rising social and economic inequality.

But in the long-term, such an unconditional plan might turn people away from hard work, innovation and entrepreneurial urge and innovation.

Over the long haul, depending on the socioeconomic effects of such a supplementary income plan, the proposition might need a balancing act both from the state and the society.