It is generally believed that over 30 percent of Pakistan’s US $ 300 billion economy is undocumented. This is mainly due to successive governments’ failure over the last seven decades to bring people into tax net. At present, only about 1 per cent of its 208 million population file income tax returns and key industrial sectors dominated by powerful lobbies pay little or no taxes at all.

Most of over Rs 4000 billion tax revenue collected by the government every years comes from indirect taxes like general sales tax.

This scenario has resulted in the development of economy that is not a part of official system.

This informal segment of the economy also termed black economy or hidden economy, is thriving and growing despite efforts by Pakistan’s central bank and Federal board of Revenue to document the economy.

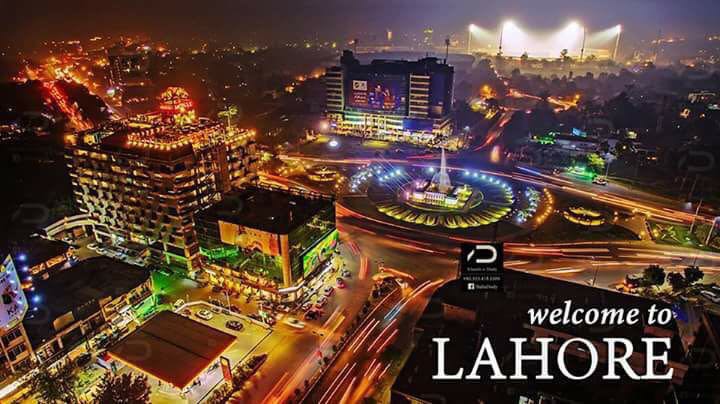

A view of Lahore with cricket floodlit cricket stadium in the background. Photo: Roshan Pakistan via PCB

The reasons for governments’ failure on the economic front is the mistrust of both investors and businessmen regarding government institutions.

Lately, Pakistan’s government led by Prime Minister Imran Khan has tried to bring all businesses into the tax system. The Administration introduced a tax amnesty scheme in June to encourage people to declare the assets they had concealed in their returns over the years.

But this scheme helped add another Rs. 70 billion taxes to the national coffer against Rs. 124 billion collected in a similar scheme introduced by former Prime Minister Nawaz Sharif about two years ago.

Now the government has stepped up the process to broaden the tax base bringing more and more professions and trade into the tax net. Their target is to convince traders to make transactions through banking channel so that every piece of trade is documented.

In Pakistan, Azam Cloth market and Shahalam market in Lahore and Jodia Bolton market and Shershah in Karachi are the business centers with hundreds of billions rupee transactions every day.

But the government of Pakistan does not collect the tax from these markets, as they should.

The ongoing effort to document the economy is facing stiff resistance from the business community.

Pakistani traders went on a nationwide strike on Saturday disrupting business activities to protest the new taxes and the government’s new drive to document commercial activity.

There was a mixed response to the strike as majority of the traders in Karachi, Lahore and Islamabad promptly responded to the call by All Pakistan Anjuman-e-Tajiran (All Pakistan Traders Associations ).“All Pakistan Anjumn-e-Tajran has observed the countrywide shutter-down strike from Karachi to Khyber-Pakhtunkhwa and Kashmir to Gwadar in protest of unfair taxes imposed by the federal government in budget 2019-20,” a jubilant APTA General Secretary Naeem Mir claimed in Lahore, the eastern city of Pakistan.

In Karachi, the country’s main commercial hub, around 80 per cent of markets dealing in bulk goods were closed.

This is not the first time that traders have vehemently opposed any government effort to document economy. Markets in Pakistan remained closed for almost 26 days when former military dictator tried broaden tax base under Tax survey scheme in December 2000.

Pakistan’s international creditors often point out low tax collection and stagnant tax net as a key cause for the country’s economic woes. The current drive to document the economy times with some chronic economic challenges including the balance of payment, gaping trade deficit and mounting debts.

Faisalabad Clock Tower Image Credit: Minhajian /Wikimedia

Pakistan’s businesses came to a grinding halt on August 1, 2015 on the call of Anjuman Tajiran against the imposition of withholding tax on banking transactions by former Prime Minister Nawaz Sharif.

As of now, it seems it is up to traders how they choose to respond to the documentation drive. The Imran Khan government may need some smart negotiating skills to reach an agreement on documentation of the commercial activity in a way that takes traders into confidence.

![Photo:By Rahib ALi (Citizen)) [Public domain], via Wikimedia Commons](https://www.viewsnews.net/wp-content/uploads/2016/01/IICROAD.jpg)